A huge shake up of the way we pay for everyday items is coming, thanks to a groundbreaking new Australian-first deal.

Aussie shoppers could soon use buy now, pay later to purchase everyday essentials like milk and fuel.

In a nationwide first, up and coming financial services platform Fupay has inked a new deal with retail giants IGA, Foodworks and United Petroleum to provide short-term loans of up to $500 for customers.

It’s the first time such a platform has been able to crack the supermarket and petrol sectors, and will mean Aussies will be able to pick up staples without paying for them at the time.

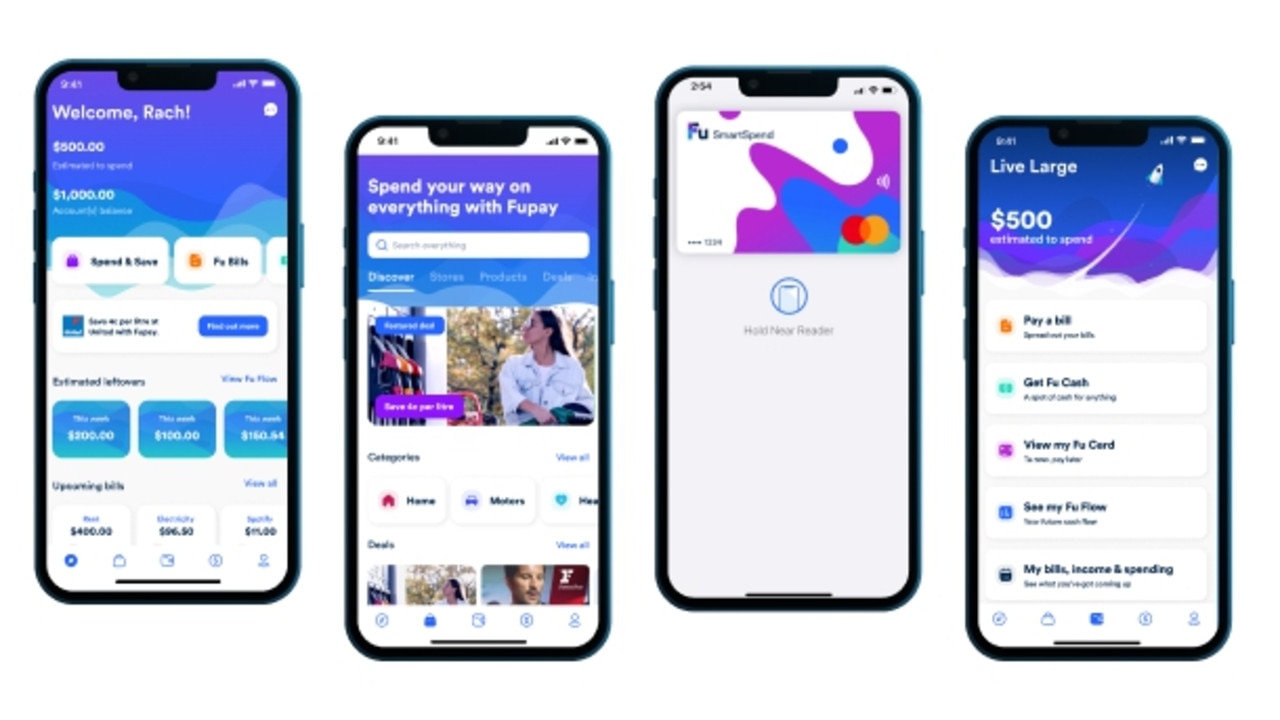

According to the Fupay website, the company is a “first-of-its-kind lifestyle management platform allowing young Millennials to better understand and manage their cashflow needs” that combines “modern money management with the ability to BNPL ALL lifestyle categories (including essential expenses such as groceries and household bills) and discover personalised savings and rewards”.

“It’s an exciting development for us in providing that responsible payments smoothing solution where it’s needed most by consumers,” Fupay co-founder and managing director Michael Fredericks told the The Advertiser in the wake of the deal being confirmed.

“In terms of payments smoothing, our focus is on the everyday spending categories – relative to that our data shows that’s where the greatest need is in terms of our transactions.”

According to research from the Australian Securities and Investments Commission (ASIC), the number of buy now, pay later transactions skyrocketed from 16.8 million in the 2017-18 financial year to 32.0 million in the financial year 2018-19, representing a staggering increase of 90 per cent.

That upwards trend continued over the course of the pandemic, with the total value of transactions growing by 43 per cent to June 2020.

But ASIC’s Victorian regional commissioner and chief operating officer Warren Day told ABC Melbourne Drive last year there was a downside to the popular method.

“Buy now, pay later arrangements have been great for many Australians, allowing them to buy and receive goods and services immediately from a merchant and repay the BNPL provider over time,” he said at the time.

“Unlike a traditional loan or credit card, consumers don’t pay interest on purchases. Instead, they may be charged fees, such as account keeping fees, establishment fees and missed payment fees.

“While BNPL arrangements are working for many, ASIC is aware some consumers are incurring missed payment fees and report being financially stressed. In fact, BNPL users were more likely than the general population to experience financial stress in the last 12 months … and more than twice as likely as credit card holders.”

Advice from the government’s Moneysmart website explains BNPL users should stick to a limit and aim to have only one buy now pay later account at a time, budget for bills, loan payments and buy now pay later payments and consider linking buy now pay later accounts to debit cards instead of credit cards, to avoid credit card interest.

Extracted from News.com.au